Why European Stocks Are Outperforming the U.S.

Over the past few years, the balance of performance between European and U.S. stock markets has started to shift. For a long time, U.S. equities — particularly the large-cap technology sector — dominated global investment flows and delivered stronger returns. However, recent developments suggest that Europe is regaining momentum, driven by more favorable valuations, sector dynamics, and policy trends that are strengthening its economic foundations.

Economic Growth and Recovery in Europe

Europe’s economic performance has proven more resilient than many expected. Despite challenges such as high energy prices and global supply chain disruptions, the region’s manufacturing base and consumer spending have remained stable.

A renewed focus on industrial production and infrastructure has become one of the main drivers of growth. Many European governments are investing heavily in energy transition projects, digitalization, and defense spending. These initiatives have supported local industries and contributed to stronger corporate earnings.

Inflation has also started to cool across much of the Eurozone. This has reduced pressure on consumers and businesses, creating a more balanced growth environment compared with the past few years of inflation-driven uncertainty.

Monetary Policy: A Supportive Shift

Another reason for Europe’s relative strength lies in expectations around monetary policy. While the U.S. Federal Reserve remains cautious about cutting interest rates, the European Central Bank is expected to move sooner due to slower inflation and softer economic demand.

This anticipated shift could lower borrowing costs across the continent, improving corporate profitability and supporting investor confidence. Lower rates often make bonds less appealing and boost stock valuations by reducing financing costs for companies.

As markets price in these expectations, European equities have begun attracting renewed interest from international investors seeking diversification beyond the United States.

Valuations: Europe Looks More Attractive

One of the key reasons behind Europe’s outperformance is valuation. European shares generally trade at lower price-to-earnings ratios than those in the U.S., making them appear more affordable.

For several years, U.S. stock markets were dominated by a small group of large technology companies that pushed overall valuations higher. While these firms remain profitable, their elevated prices have left the market looking expensive and top-heavy.

Europe’s stock markets, by contrast, offer a more balanced mix of sectors such as banking, industrial manufacturing, energy, and consumer goods—industries that tend to do well during economic recoveries. Investors searching for value and income are increasingly drawn to Europe’s equity landscape.

Sector Dynamics: A Different Market Composition

The structure of Europe’s markets gives them an advantage in the current environment.

The U.S. market is heavily weighted toward technology, digital services, and consumer discretionary companies. These sectors thrived in a low-interest-rate world but can face pressure when borrowing costs rise or when investors become more cautious about growth expectations.

Europe, on the other hand, has greater exposure to financials, energy, and industrial firms—sectors that benefit from higher interest rates, infrastructure spending, and government stimulus. Banks have become more profitable thanks to rising interest margins, while defense and energy companies are seeing strong demand due to global uncertainty and public investment.

Fiscal Policy and Government Spending

Fiscal policy has become an important growth driver for Europe. After years of austerity, governments across the continent have launched ambitious public investment programs in defense, green technology, and infrastructure renewal.

A key part of this effort involves improving energy independence. The recent volatility in global energy markets has accelerated Europe’s push toward renewable energy and domestic production. These projects not only stimulate economic growth but also strengthen Europe’s long-term competitiveness in emerging industries.

Meanwhile, fiscal expansion in the U.S. is expected to slow as policymakers focus on inflation control and deficit reduction, giving Europe a relative advantage in attracting capital flows.

Currency Stability and Export Competitiveness

The euro’s stability has also supported investor confidence. After a period of weakness in 2022 and 2023, the currency has steadied against the U.S. dollar, making European assets more appealing to global investors.

A stable currency environment supports export competitiveness, especially as demand from key partners in Asia and North America remains strong. Europe’s diverse industrial base allows it to adapt effectively to shifts in global trade dynamics.

Investor Sentiment and Market Rotation

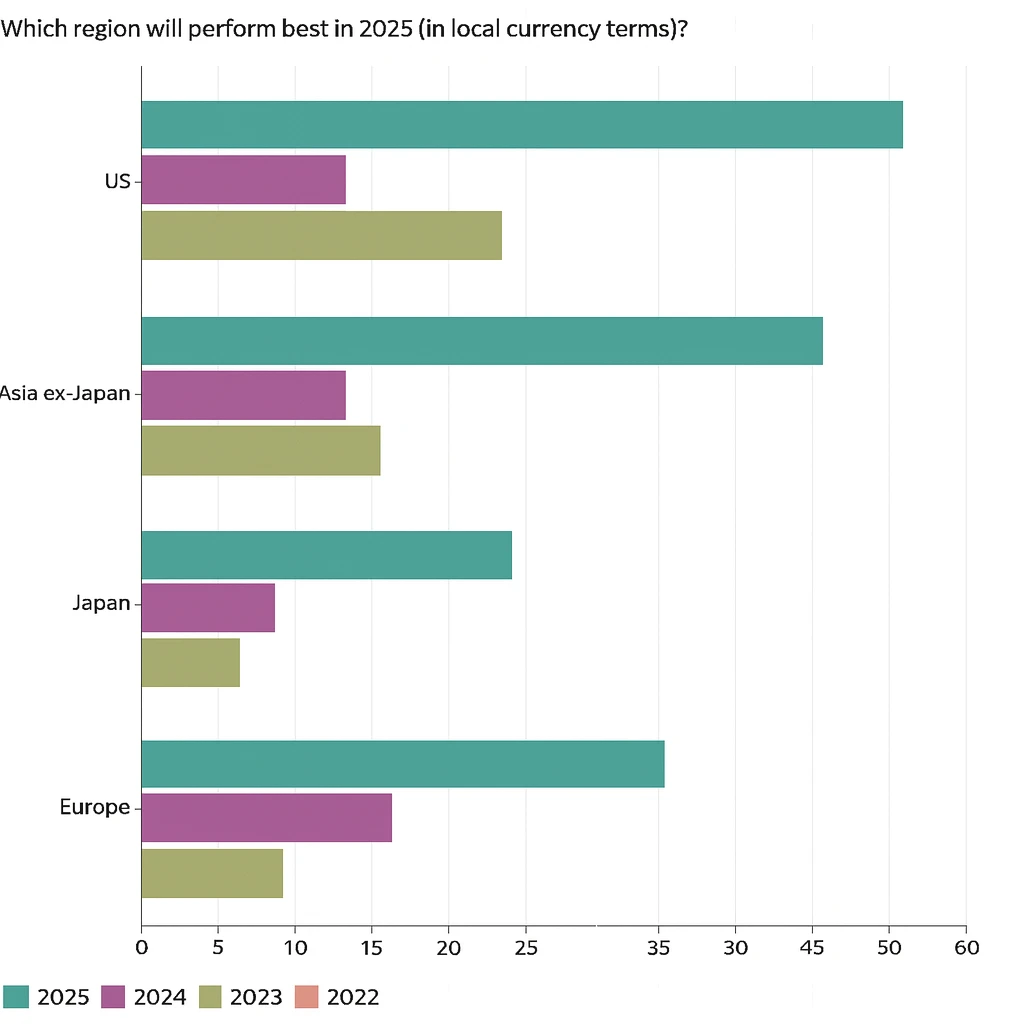

Investor sentiment is shifting in favor of European markets. Global investors looking for diversification and value are increasingly turning to Europe after years of underperformance compared to the U.S.

European equities now offer a mix of reasonable pricing, improving growth prospects, and declining inflation pressures. Institutional investors have been reallocating funds toward European assets, especially in cyclical sectors and companies offering reliable dividends.

In addition, many European corporations have strengthened their balance sheets and adopted more disciplined capital strategies, making them attractive in a world where stability and predictable returns matter more than speculative growth.

The Broader Global Context

Globally, investors are adapting to an environment of moderate but steadier growth. The world economy is becoming more regionally diversified, with Europe, the U.S., and parts of Asia each playing distinct roles in global capital markets.

The U.S. continues to be a key driver of innovation and financial strength, but Europe’s improving fundamentals have helped it close the performance gap. As inflation moderates and interest rates ease, the two regions are entering a more balanced investment phase.

Conclusion

The stronger performance of European stocks compared with U.S. equities reflects a mix of structural, economic, and policy-related factors.

Europe’s fiscal initiatives, improving corporate earnings, attractive valuations, and balanced sector exposure have made it an appealing option for investors looking beyond the United States.

While uncertainties remain—from political risks to uneven growth across member states—Europe’s progress signals a shift toward a more diversified and competitive global market landscape.

For long-term investors, this serves as a reminder that opportunities often arise in regions that have been overlooked for too long.