Despite the climate of uncertainty, the global stock market has reached a new all-time high. Investors are focusing on what truly matters: expectations and economic fundamentals, which are proving more resilient than expected.

There’s no shortage of opportunities in equity markets. The classic rules remain unchanged: diversify and think long term.

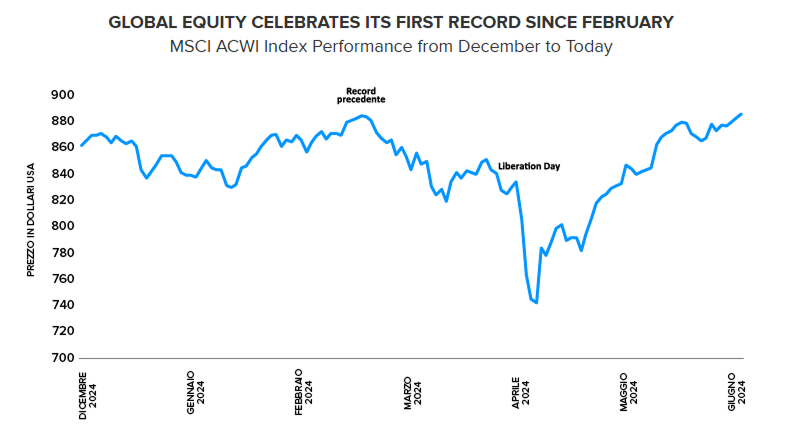

Escalating tariffs, geopolitical tensions, and concerns about U.S. debt suggest a bearish scenario — yet the MSCI All-Country World Index recently set a new record, gaining 5.65% year-to-date as of June 4, 2025.

Markets are focusing on essentials:

Trade is uncertain, not collapsing

Economic conditions are holding up

A softer tone on tariffs and better-than-feared corporate earnings helped fuel the recovery. Despite uncertainty, the economy continues to show resilience.

The S&P 500 delivered one of its strongest Mays since 1990, supported by April’s rebound and despite tariff-related volatility.

This strength came amid:

Moody’s removal of the U.S. AAA rating

Global geopolitical tensions

Ongoing tariff negotiations

Legal rulings challenging tariff legitimacy

Even in this environment, markets emphasize essentials: governments remain determined to support growth worldwide.

The One Big Beautiful Bill Act (OBBBA), approved by the House on May 22, proposes extending the 2017 Tax Cuts and Jobs Act, reducing bank capital requirements, and boosting energy production.

Though the Congressional Budget Office expects both tax reductions and deficit increases, markets are concentrating on the bill’s primary objective: stimulating growth.

Recent data supports improved sentiment:

Consumer confidence jumped to 98 in May

Purchasing manager indices rose above key thresholds

Corporate earnings remain strong

The tech sector’s latest earnings have reignited enthusiasm, with leading companies hitting new highs. Investors are considering the possibility of tech once again driving broader market growth.

Historically, when the S&P 500 gains over 5% in May, the following year averages nearly 20% returns, reinforcing optimism.

According to Bloomberg, eight of the ten best-performing stock markets from January to May are in Europe, including Germany, Poland, Greece, and Hungary.

The Stoxx 600 has also performed strongly, supported by new fiscal policies in Germany and a strengthening euro.

It’s a favorable period for equities globally, but the basic rules remain:

Diversify — distribute investments across regions and sectors

Think Long Term — historically, equity markets reward patience

In short: opportunities are present, but discipline and perspective remain key.