Online and mobile banking

Explore Neo’s pension fund, designed to help you build a secure and prosperous future. With tailored solutions and long-term stability, it supports your financial goals at every stage of life.

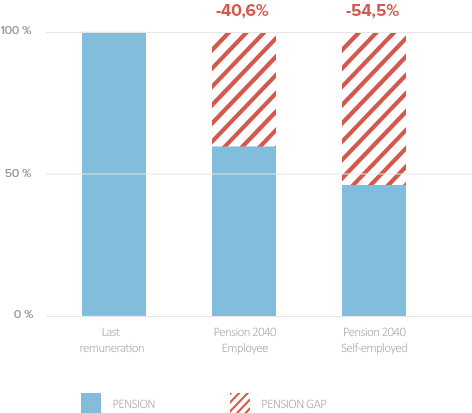

How much will your pension provide? Will it be enough to maintain your current lifestyle?

According to projections, by 2040, an employee with 38 years of contributions may receive a pension equal to roughly 60% of their last salary, while a self-employed worker may receive around 45.5%, assuming average economic growth.

To enjoy retirement with peace of mind, it’s crucial to start planning early and consider additional pension solutions now.

Choose from five investment lines managed with a focus on ESG criteria. You can combine them and have the option to reallocate after the first year.

Whether you are an employee, self-employed, or want to set up a savings plan for your dependents, Core Pension helps secure your financial future.

Annual contributions may be deductible from taxable income, up to €5,164.57, providing potential tax savings.

Fund your account as you wish, either with one-time payments or through regular contributions of any amount.

Subscribe online to your preferred Core Pension line, or combine multiple lines to create a portfolio tailored to your goals: Guaranteed, Bond, Balanced, Stocks, Equity Plus.

Core Pension Guaranteed offers a safety net, making it ideal for investors with a low risk tolerance.

Objective: To achieve modest capital growth

Time horizon: Medium term

Risk: Medium

Core Pension Bond suits those with a few working years left who seek balanced growth with moderate risk.

Objective: To achieve modest capital growth

Time horizon: Medium term

Risk: Medium

Core Pension Balanced suits those with many working years ahead who aim for growth with a medium-high risk profile.

Objective: To achieve moderate capital growth

Time horizon: Medium-long term

Risk: Medium-high

Core Pension Stocks is ideal for those with many working years ahead who are willing to take on a medium-high level of risk for greater growth potential.

Objective: To achieve capital growth

Time horizon: Long term

Risk: Medium-high

Core Pension Balanced suits those with many working years ahead who aim for growth with a mediuam-high risk profile.

Objective: To achieve significant capital growth

Time horizon: Long term

Risk: High

A pension fund can be one of the most valuable gifts for your child’s future — helping them build long-term financial security from an early age.

Core Pension accounts can be opened in the name of a minor or dependent through a Financial Advisor.

If you’re already a customer, you can request a callback directly from your personal area.

If you’re not yet a customer, simply reach out to a local financial center for more information.

Core Pension is designed to complement state pension systems across the European Union, supporting your long-term retirement goals through diversified investment lines.

The pension solutions are managed by EuroVest Capital Management, an independent European asset management company regulated within the EU. Specific terms, conditions, and tax advantages depend on your country of residence.