November 19, 2024 Content by Wealthype.ai

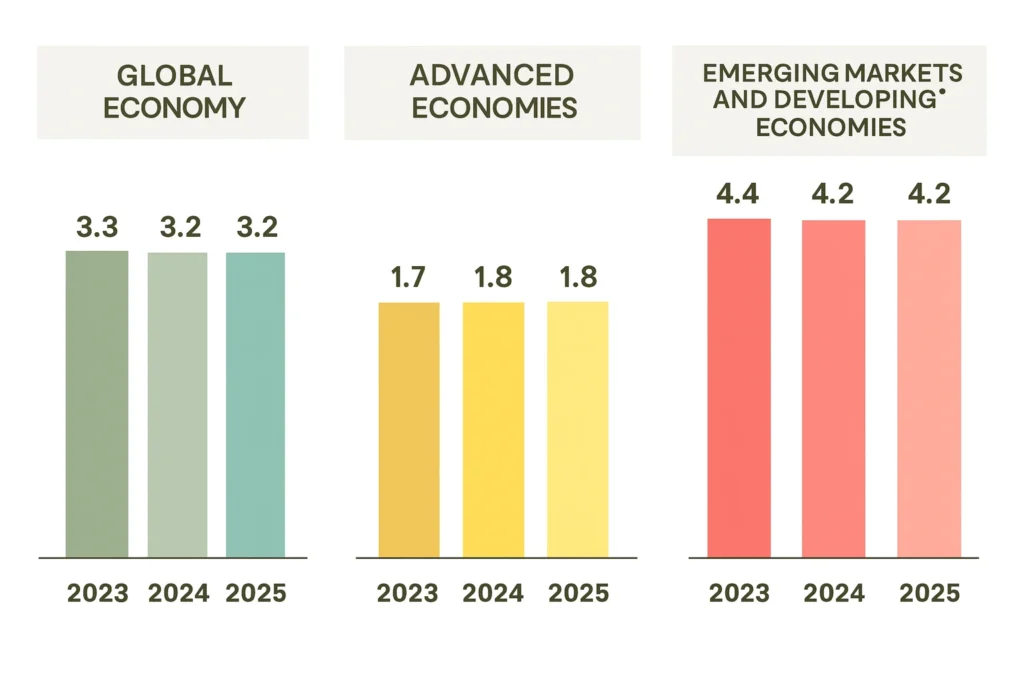

In its latest October reports, the International Monetary Fund (IMF) updated its outlook for the global economy and public finances. Growth is projected to hold steady and inflation to ease further, but the IMF is sounding the alarm on debt. Future debt issuance could create opportunities for investors, though diversification remains essential.

The IMF’s World Economic Outlook (October 2024) outlines stable global expansion, accompanied by a gradual cooling of inflation. Yet the Fund continues to urge countries to maintain strict control over public finances — a recommendation that has become something of a global mantra.

Alongside the World Economic Outlook, the IMF also released its Fiscal Monitor, which focuses on the fiscal strategies of its member states. Both publications stress the need for governments to strengthen fiscal discipline and rebuild financial buffers to safeguard against future shocks.

The IMF identifies three major pivots — turning points for the global economy as inflation nears central banks’ targets:

Monetary Pivot: Central banks in advanced economies have begun cautiously lowering interest rates since mid-2024, signaling the first phase of normalization.

Fiscal Pivot: Governments must now stabilize debt trajectories and restore fiscal capacity.

Structural Pivot: Long-term reforms are needed to enhance productivity and sustainability — the most complex challenge of all.

Among these, markets seem most focused on public debt, which, instead of declining, continues to climb.

According to the October Fiscal Monitor, global public debt will surpass 100 trillion dollars this year. After a temporary decline between 2021 and 2022, the total has risen again in 2023 and could reach 100% of global GDP by 2030. The trend is driven primarily by the world’s two largest economies — the United States and China.

These findings come just before key political moments: U.S. presidential elections and China’s Standing Committee meeting to finalize a massive economic stimulus plan. Future IMF reports are unlikely to show any improvement in their fiscal outlooks.

In January 2025, twenty days before President-elect Donald Trump takes office, the U.S. federal debt ceiling will be reinstated. First introduced in 1917 during World War I, the ceiling allows the Treasury to issue debt only up to a defined limit before returning to Congress for authorization. The current suspension, granted under the Biden administration, expires on January 1, 2025.

Outgoing Treasury Secretary Janet Yellen will likely use emergency measures to manage liquidity, but the incoming administration must soon negotiate an extension or raise the ceiling (currently set at 31.4 trillion dollars). With Republican control of both chambers, Trump is expected to renew and expand the 2017 Tax Cuts & Jobs Act, lowering taxes across the board — at the cost of a higher debt-to-GDP ratio.

Meanwhile, China is readying a colossal 10 trillion yuan fiscal package aimed at supporting heavily indebted local governments and reigniting growth. Beijing has also hinted at a more aggressive fiscal stance for 2025, potentially announcing additional stimulus measures once the new U.S. administration’s trade policies are clear.

This comes as Trump has pledged 60% tariffs on Chinese goods, a move that could pressure an economy still dependent on exports. The timing of China’s announcement — after the U.S. election — appears deliberate.

The combination of lower taxes and higher tariffs points to a scenario of renewed inflationary pressure. Markets are already reflecting this, with U.S. Treasury yields trending upward. For investors, increased bond issuance may present attractive opportunities, though careful diversification remains essential.

Europe, too, faces fiscal challenges: rising defense spending, the green transition, and potential trade tensions with the U.S. make a return to austerity unlikely. Debt instruments can provide yield opportunities, but they carry risks, and equities have historically delivered stronger long-term returns.

Following Trump’s victory, the S&P 500 hit its 51st record high of 2024, surpassing 6,000 points — its best year-to-date performance since 1995. Yet, as always, investment choices should be guided by personal goals and risk profiles, not by market headlines alone.

The world’s debt burden is once again climbing toward the size of the entire global economy. While this creates potential openings for investors, it also underscores a familiar warning: growth and fiscal prudence must advance hand in hand.